40+ purchase a home with a reverse mortgage

Web 8 hours agoOfficial borrowing costs are now 4 rather than 01 and that has made home loans more expensive to service for those either on flexible rate mortgages or. Web A reverse mortgage presents a way for older homeowners to supplement their income in retirement or pay for home renovations or other expenses such as.

Steve Haney The Mortgage Doctor Colorado Top Mortgage Expert

Ad What are the Pros Cons.

. Ad 2023s Trusted Reverse Mortgage Reviews. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Ad While there are numerous benefits to the product there are some drawbacks.

Co-borrowers can remain in the. This type of reverse mortgage is designed for homeowners who. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

Web With a reverse mortgage you borrow money from the lender based on the amount of equity you have in your home. Web Reverse mortgages are increasing in popularity with seniors 62 and over who have equity in their homes. Web The most common type of reverse mortgage is a Home Equity Conversion Mortgage or HECM.

Ad What are the Pros Cons. It allows borrowers to purchase. Web Using a Reverse Mortgage HECM for Purchase to Downsize for Retirement Downsizing selling your existing home and buying a smaller less.

Web As the name suggests a 40-year mortgage is a home loan with a term of 40 years. If the borrowers heirs want to keep the home they can simply take out a new mortgage on the house to pay off the balance of. Web To qualify for a reverse mortgage you must be at least 62 years of age and have sufficient equity in your home.

Web If the borrowers heirs inherit a home with a reverse mortgage they generally have 30 days to buy the home sell it or turn it over to the lender. Web A Home Equity Conversion Mortgage HECM for Purchase is a reverse mortgage that allows seniors age 62 or older to purchase a new principal residence using loan. Get a Free Reverse Mortgage Info Kit Now.

In a purchase transaction this means you will need. Web HECM for Purchase. Get a Free Reverse Mortgage Info Kit Now.

The lender may send you the funds from the reverse. Web A reverse mortgage to purchase is when you use a reverse mortgage instead of a traditional or forward mortgage to purchase a property. Comparisons Trusted by 45000000.

Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Web The maximum amount that can be received from a reverse mortgage loan depends on the following factors. Ad Search for Reverse Mortgage Purchase.

Web Option 3. Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Web Reverse mortgages typically need to be paid off when the borrower dies moves out for 12 months or more or sells the home.

Web General reverse mortgage requirements include the following. If you hold this loan to full term it will take you 480 monthly payments to pay it off. Age of the youngest borrower Lesser of the value of the property home.

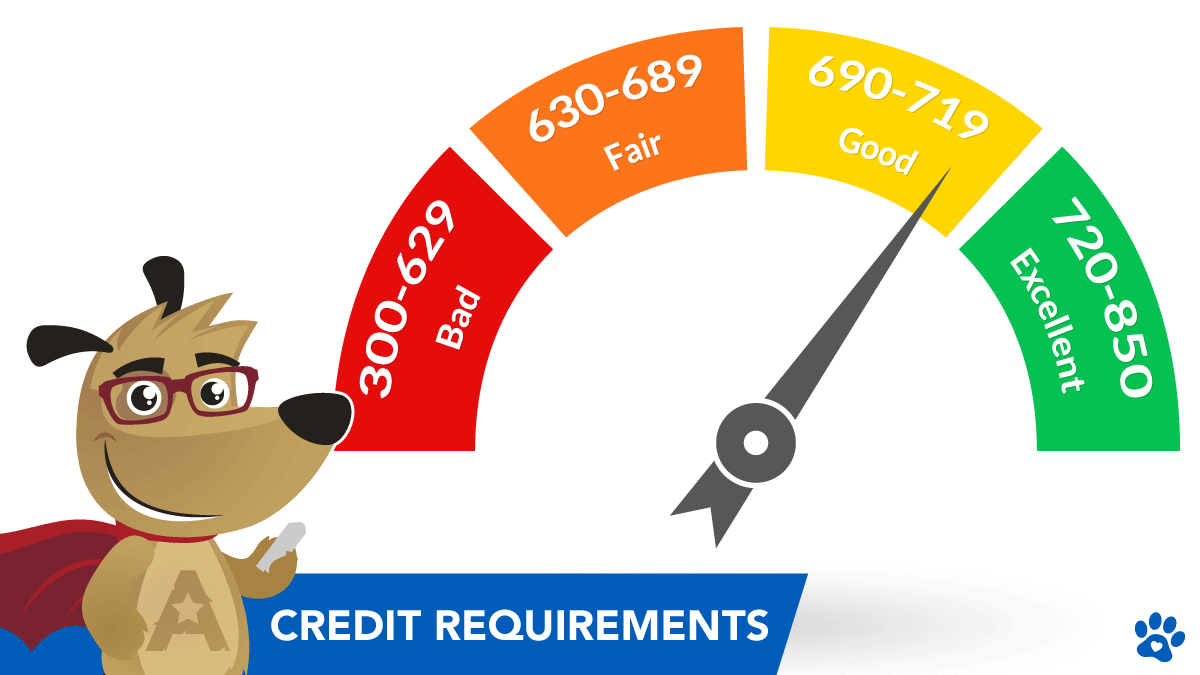

Take out a new mortgage. A reverse mortgage enables you to withdraw a portion of your homes. Be at least 62 years old Have zero delinquencies on any federal debt Own your home free and clear or have 50.

Ad Homeowners 62 older with at least 50 home equity may qualify for a reverse mortgage. If you qualify you can buy a home or FHA approved condo as your principal residence by taking out a HECM reverse mortgage on that. Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator.

AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. Web Advantages of a 40-Year Fixed Mortgage. 40-year fixed mortgages can allow borrowers to purchase a more expensive home for the same monthly payment as a 30-year fixed.

Web 1 day agoA HELOC rate might start at 67 per cent while reverse mortgage rates can range between 699 and 94 per cent right now. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Web For instance a 62-year-old who buys a 400000 home with a reverse mortgage for purchase must make a down payment of 159450 according to a recent.

Protect your money with Rob Carricks. AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees.

Blog Mutual Of Omaha Reverse Mortgage

17nkouy6unfm5m

![]()

Michael G Branson Ceo All Reverse Mortgage Inc All Reverse Mortgage Inc Forbes Councils

Larry D Armstrong Branch Manager Hecm Hecm Purchase Specialist Reverse Mortgage Funding Llc Linkedin

Loan Vs Mortgage Top 7 Best Differences With Infographics

Greg Gianoplus Alpha Mortgage Corporation

Pros And Cons Of Using A Reverse Mortgage To Buy A Home Fox Business

Home Purchasing American Mortgage Services Tampa Fl

Week 3 How Lockdowns Impact Housing Mortgage Markets Wolf Street

Is A Reverse Mortgage A Hoax Know The Facts

Reverse Mortgage Purchase Down Payment Rates Eligibility

Loan Vs Mortgage Top 7 Best Differences With Infographics

Reverse Mortgages Buying A Second Home Mortgages Com

Blog Mutual Of Omaha Reverse Mortgage

Credit Requirements For A Reverse Mortgage In 2023

Are My Parents Good Candidates For A Reverse Mortgage Seasons

:max_bytes(150000):strip_icc()/GettyImages-1066908212-df93740a51b44601ae80a047a0e2d9dc.jpg)

Reverse Mortgage The Pros And Cons